Industry Trends

PCB Industry Analysis and Trend Report

I. Industry Development History & Technological Evolution

PCB (Printed Circuit Board) technology originated in the early 20th century, progressing through three pivotal phases:

- Emergence Period (1900s–1940s): In 1903, German engineer Albert Hanson proposed the concept of conductive patterns. In 1936, Austrian Paul Eisler developed the first functional PCB for radios. During WWII, PCBs were adopted by the U.S. military for proximity fuses, marking the beginning of industrial applications.

- Commercialization and Popularization (1950s–1980s): After transistors replaced vacuum tubes, PCBs entered the consumer electronics sector. Breakthroughs in copper-clad laminate (CCL) technology emerged in the 1950s, integrated circuits drove multilayer board development in the 1970s, and surface-mount technology (SMT) became mainstream in the 1980s.

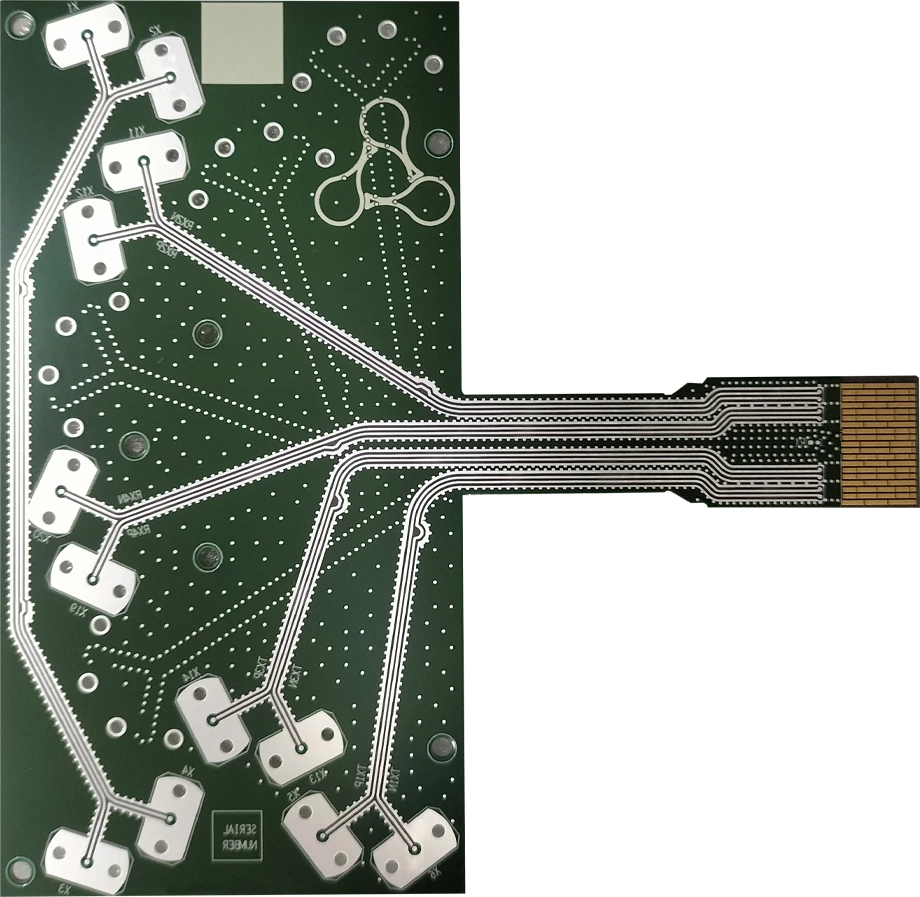

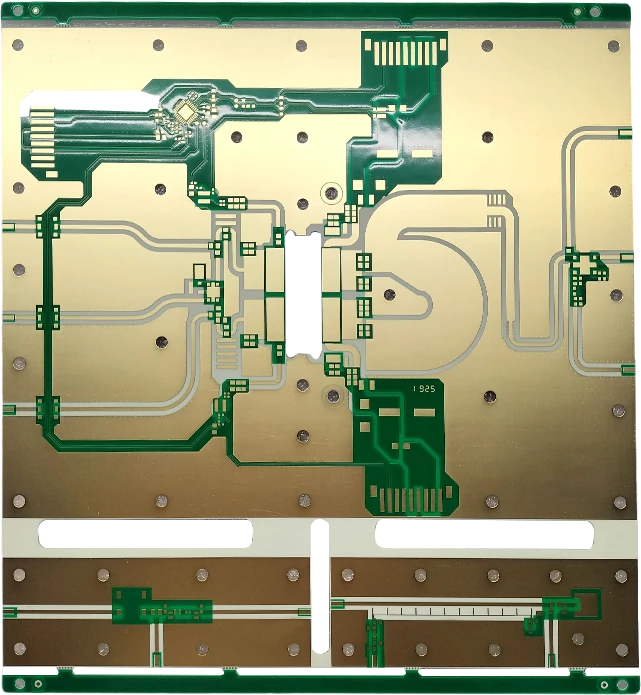

- High-Density and Intelligentization Era (1990s–Present): High-density interconnect (HDI) technology rose in the 1990s. Post-2000, flexible PCBs (FPCs), IC substrates, and high-speed/high-frequency boards advanced rapidly. Since 2010, 5G, AI, and new energy vehicles have driven PCB evolution toward high precision, miniaturization, and high-frequency performance.

II. Global Regional Development Landscape

- U.S., Europe, and Japan: Early market leaders, accounting for over 70% of global output before 2000. However, production has shifted to Asia, with these regions now focusing on high-end substrates and high-frequency boards. China has become the global PCB manufacturing hub, contributing 54.6% of global output in 2023, concentrated in the Pearl River Delta and Yangtze River Delta. Taiwan (China), Japan, and South Korea dominate high-end markets (e.g., HDI, IC substrates), while the U.S. and Europe retain some military and aerospace production.

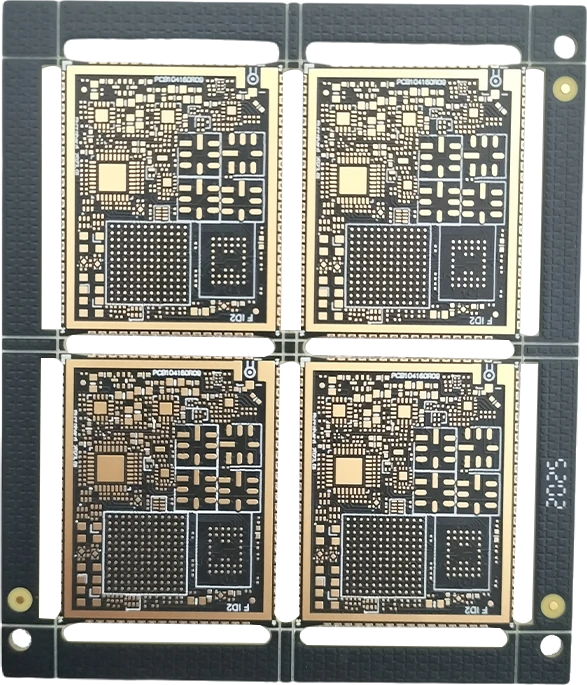

- China Mainland: Initially focused on mid-to-low-end multilayer boards, but companies like Zhen Ding Tech (Avary Holding) and Shennan Circuits now rank among the global top 10. In 2024, China’s output share rose to 55.74%, driven by decades of industrial accumulation, a growing talent pool, and equipment localization. China now produces advanced products such as high-layer boards, HDI, rigid-flex boards, IC substrates, and high-speed boards.

- Industry Relocation Trends: Mid-to-low-end production continues shifting to Southeast Asia due to cost and policy factors, while China is penetrating high-end markets through technological upgrades.

III. Application Sectors

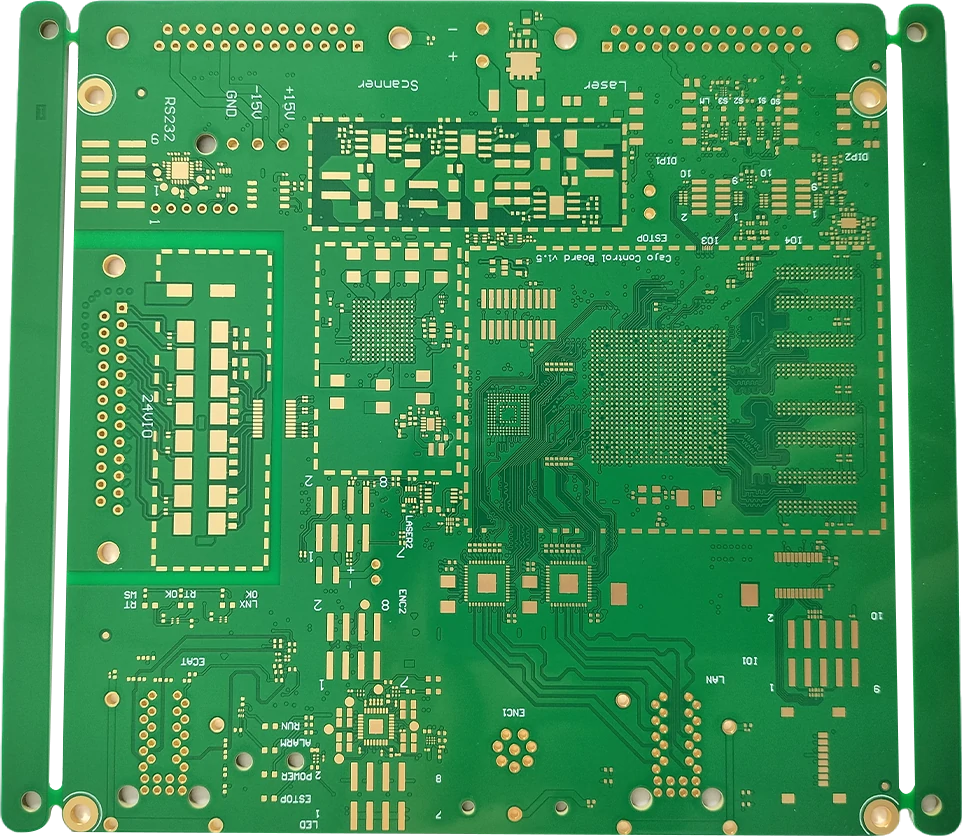

- Communication Equipment (30%): 5G base stations, servers, and AI accelerator cards drive demand for high-speed PCBs. 800G/1.6T optical module PCBs are emerging as key focus areas.

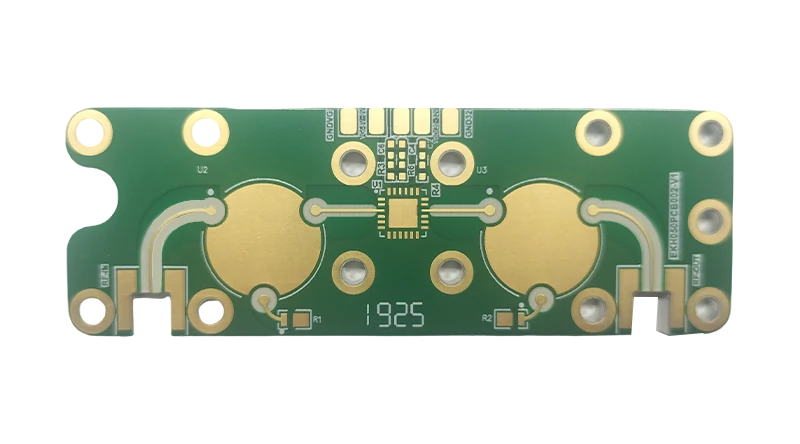

- Automotive Electronics (25%): New energy vehicles require 5x more PCBs than traditional cars. Demand surges for ADAS (e.g., autonomous driving modules, millimeter-wave radar) and battery management systems.

- Consumer Electronics (20%): Smartphones and wearables propel HDI and FPC adoption. Foldable smartphones increase per-unit PCB value by 30%.

- Industrial & Medical: Stable demand for industrial controls and medical imaging equipment, with niche markets growing faster than the industry average.

IV. Market Size & Competitive Landscape

Market Size:

- Global PCB output reached 78.3 billion USD in 2023, with China accounting for 54.6% (37.7 billion). China’s share rose to 55.74% (48.1billion) in 2024. The global market is projected to reach 90.4 billion by 2028, with a CAGR exceeding 5.4%.

- IC substrates and HDI boards show the fastest growth (CAGR 8.8%), while traditional rigid boards slow (CAGR 3.1%).

Competitive Landscape:

- Global: Fragmented competition; the top five players hold less than 20% market share. Japan/South Korea lead high-end IC substrates (e.g., Ibiden), while Taiwan (China) excels in HDI and FPCs.

- China: CR5 is 33.9%, with Zhen Ding Tech (12.4% share), Dong shan Precision, and Shennan Circuits leading in communication and server sectors.

V. Product and Technology Trends

High-End Development:

- High-Layer Boards: AI servers drive layer counts from 12 to 24+ (e.g., NVIDIA H100 uses 5th-gen HDI 20-layer boards).

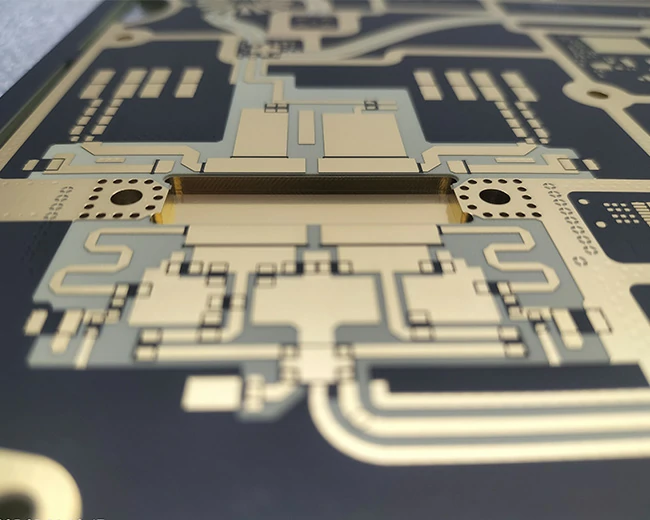

- HDI: Line width/spacing reduced below 20μm, with stacked via technology enhancing routing density for AI servers and premium smartphones.

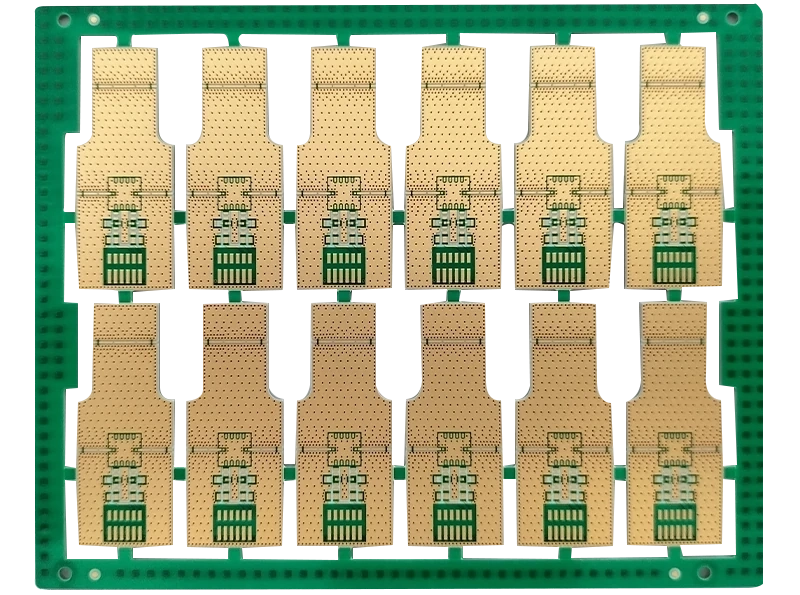

- Flexible and Rigid-Flex Boards: Wearables and foldable phones propel FPCs; global FPC market expected to exceed $15 billion by 2025.

- High-Frequency Materials: 5G mmWave and automotive radar boost demand for low-Dk materials (e.g., Rogers). Domestic substitution accelerates (e.g., Shengyi Tech).

- IC Substrates and Advanced Packaging: HBM memory and Chiplet technology drive 2.5D/3D substrate demand. Domestic players like Shennan Circuits and FastPrint Technology are scaling production.

Material Innovation: High-frequency materials (e.g., PTFE) for 5G base stations; metal-core PCBs and thick copper boards improve thermal management.

Sustainability and Smart Manufacturing: Eco-friendly processes (lead-free, wastewater treatment) are mandatory. AI+IoT-driven digital upgrades enhance production efficiency.

VI. Key Players and Customer Segments

Global Leaders:

- Zhen Ding Tech/Avary Holding (No.1 globally): Apple’s core supplier, with FPCs and SLP (substrate-like PCBs) accounting for 70% of revenue.

- Unimicron (Taiwan): Specializes in IC substrates, serving Intel and AMD.

- Shennan Circuits: Major supplier for Huawei and ZTE’s base station PCBs; holds over 20% server PCB market share.

- Victory Giant Technology: Global leader in NVIDIA GPU PCBs; second-largest supplier for Tesla’s automotive PCBs.

- Kinwong Electronics: Covers automotive and industrial sectors; key supplier for Huawei.

Customer Segmentation:

- Consumer Electronics: Apple, Samsung, and Huawei dominate high-end orders, demanding zero-defect quality and rapid delivery.

- Automotive Electronics: Bosch, Continental, and CATL push reliability upgrades for automotive PCBs.

VII. Future Outlook

- Demand Drivers: AI computing, automotive intelligence, and 5G-Advanced will sustain demand for high-end PCBs. Southeast Asia’s capacity expansion mitigates geopolitical risks, but for the pivotal tech upgrades are still relying on China.

Challenges and Opportunities:

- Localization: Breakthroughs in IC substrates and advanced HDI are crucial for domestic substitution.

- Industry Consolidation: Mergers (e.g., Victory Giant acquisition of MFS) enhance global competitiveness.

- Tech Upgrades: AI-assisted EDA design and laser direct imaging (LDI) accelerate smart manufacturing.

- Green Manufacturing: Halogen-free materials and wastewater recycling gain policy traction; EU carbon tariffs push emission reductions.

- Geopolitical Risks: Reliance on imported equipment (e.g., vacuum laminators) may hinder tech iteration under U.S. export controls.

- Market Concentration: China’s CR10 was 34.9% in 2023; consolidation intensifies, forcing SMEs to specialize (e.g., niche substrates).

As the “mother of electronics,” PCBs evolve in sync with innovation cycles. Over the next five years, high-end tech, regional competition, and green transitions will dominate. Chinese firms are transitioning from traditional manufacturing to high-value segments, driven by tech advancements and emerging applications. To secure global leadership, China must overcome material/equipment bottlenecks and capture strategic high ground in IC substrates and high-speed PCBs, transforming from a “manufacturing giant” to a “technology powerhouse” amid sustainability and global competition challenges.

Professional PCB & PCB Assembly Manufacturer & Factory

From concept to completion, your project will be under experienced project management, sparing you the hassle of untimely conference calls, communication gaps, language barriers and “real time” information gathering.